Everybody’s talking about Gen Z, the newest generation of young adults born between 1997 and 2012. Much research—both scientific and anecdotal—has been done about this demographic group over the last few years, and these are just a few of the world’s general impressions of this group: They have a short attention span. They crave instant gratification. They place a high value on social responsibility. They want employers who prioritize mental health and work-life balance.

While these generalizations (positive and not-so-positive) paint a group of millions of individuals with a broad brush, there’s one attribute of Gen Z members that can’t be denied: They’re the first generation of true digital natives. But does this digital fluency necessarily mean financial fluency? Not always.

What the finance industry needs to know about Gen Z

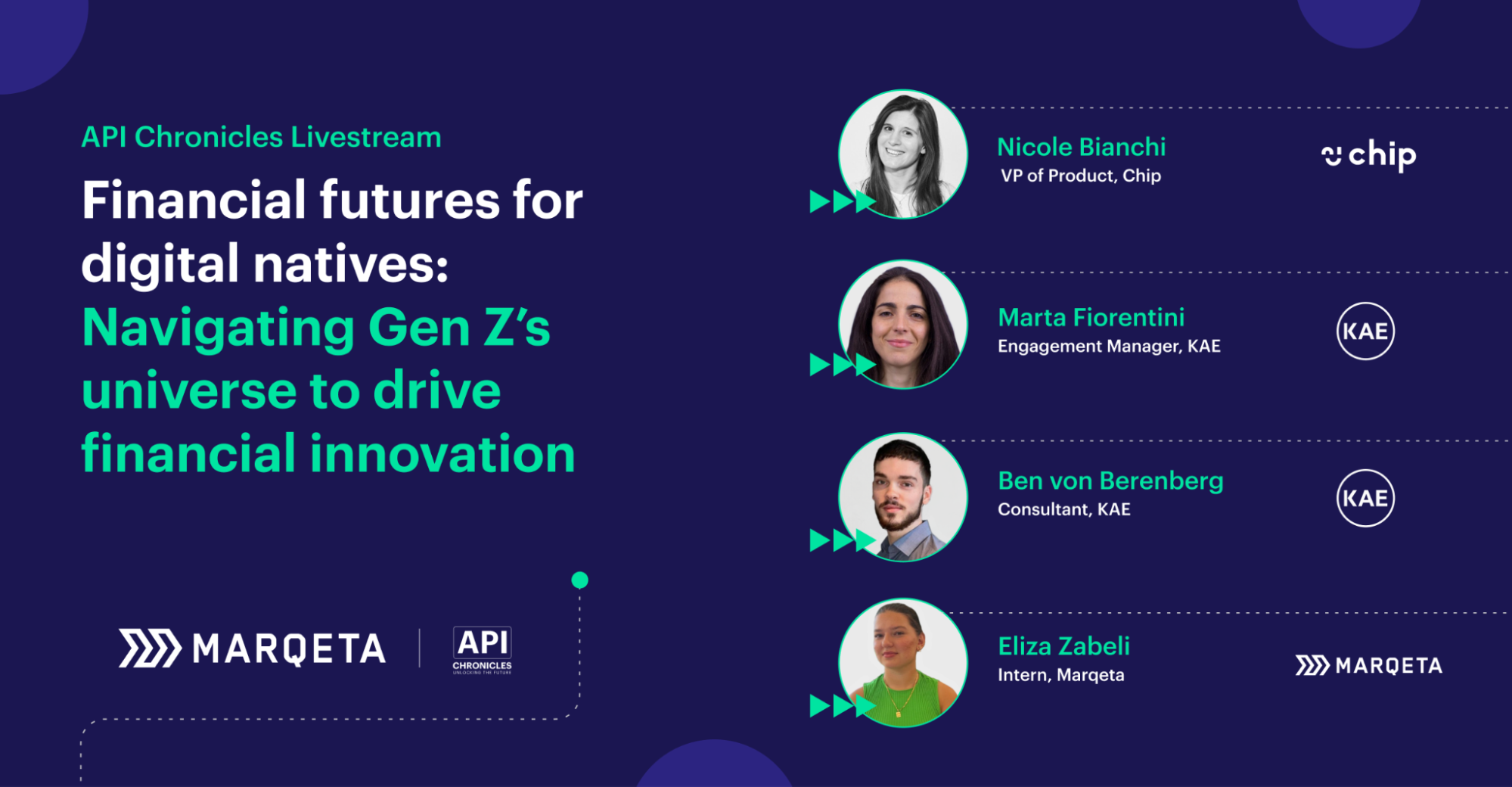

In a recent API Chronicles Livestream, Marqeta’s David Woodward, Senior Strategic Partnerships Manager, EU, sat down with financial industry experts and Gen Z individuals for an enlightening conversation about how Gen Z approaches their finances, where they get their information, and the knowledge gaps that innovative banks and fintech brands should aim to fill in order to gain traction with this enigmatic demographic group.

Our panelists included:

- Marta Fiorentini, Engagement Manager at KAE

- Nicole Bianchi, Vice President of Product at Chip

- Ben von Berenberg, Consultant at KAE (and Gen Z member)

- Eliza Zabeli, Marketing Intern at Marqeta (and Gen Z member)

Watch the full livestream now, or read on to learn more about the key takeaways from their conversation.

Takeaway #1: Not all Gen Z members are the same

For financial industry professionals interested in creating products and services that appeal to this young generation, it’s a mistake to assume that all Gen Z individuals are the same.

Like any generation, there’s plenty of nuance within this demographic group.

Broadly, Fiorentini put forth four distinct personas within Gen Z, based on recent KAE research:

- Ethical Explorers –

Low-to-middle-income earners and conscious savers who place importance on sustainability and brand reputation - Stretched Spenders –

Low income, low savings, price-conscious, and relying heavily on credit products - Energized Entrepreneurs —

Higher income, and with ambitious financial goals. They’re keen savers and have access to a wide range of financial products. - Sluggish Starters – Typically unemployed or looking for work. They have low financial engagement, a low propensity for saving, and a desire to travel.

Takeaway #2: Most save money; few invest money

According to the KAE research, Gen Z has a high propensity to save money, when their finances allow. Nine out of 10 save, with savings accounts as their preferred method. Surprisingly, in our digital world, many prioritize saving cash. The barriers to saving include not being able to afford it, prioritizing debt payoff, and a lack of willpower or interest in saving.

When it comes to investing, only three out of 10 Gen Z members currently invest, citing a need for more disposable income, more investment knowledge, and more confidence to start investing regularly.

Takeaway #3: Gen Z individuals get their financial info from family, friends, and social media

In the livestream, our Gen Z representatives noted that, often, the language used to describe financial concepts and products is perceived as overly complex and filled with jargon. As von Berenberg noted, “I do think that financial information is sometimes hidden away behind a wall of terminology that, for a lot of people, might not be as accessible.”

With this barrier, it’s no wonder that Gen Z members overwhelmingly choose to get their financial information from family and friends. They also bypass traditional financial blogs and websites, instead relying on social media “influencers” who have a knack for explaining complex financial terms in ways that feel approachable to Gen Z.

How can the financial industry engage Gen Z consumers?

These three takeaways are just the tip of the iceberg. Watch the full livestream for even more insightful takeaways and expert guidance on how both traditional banks and newer digital-first banking brands can successfully appeal to Gen Z customers. Here’s a sneak peek:

- Take a digital-first approach

- Prioritize a great customer experience and visually appealing design

- Include plenty of self-serve options

- Make the experience of interacting with your brand delightful

Check out the full livestream today to get the full story behind all these insights. Just click the play button and be sure to bookmark it for future reference.

Feeling inspired already? Then reach out to our team to learn more about how we can help you implement the financial features and benefits that appeal to Gen Z customers.