Payment Platform Overview

Simple. Trusted. Global.

Leverage our modern technology and flexible platform to create your own payment experiences across the world.

Core functionality

Easy integration

Intuitive UI

Cloud infrastructure

Core functionality

RiskControl

Your card experience

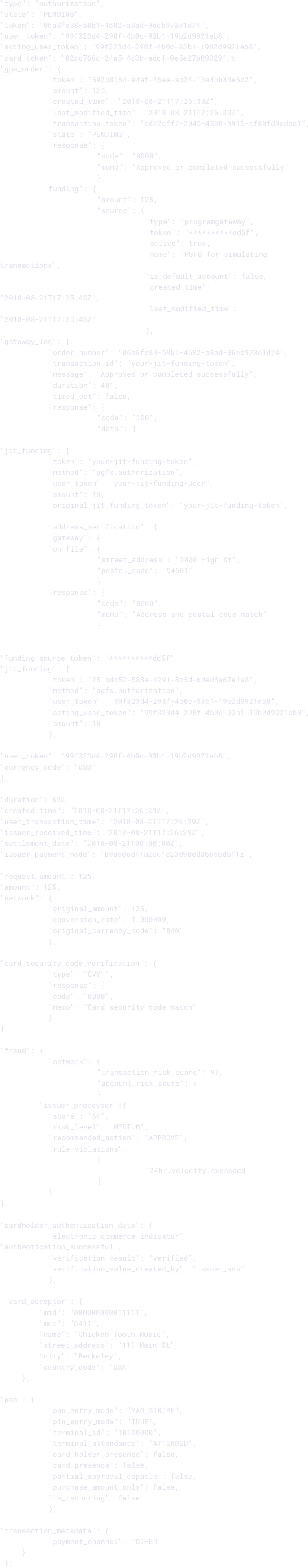

User wants to make a payment and has a physical or virtual card

Authorization happens

Verification of spend controls

JIT Funding to release funds in realtime

Transaction clears and completes

Webhooks send notifications on card activities to your system

00

:

00.00

And all of this happened in2.45 seconds

What makes Marqeta different?

The Marqeta platform lets you develop and launch innovative, global, and trusted payment solutions at unprecedented speed.

Trusted

Dynamic controls to limit spend and reduce fraud. Data insights and fraud products for visibility and control in card programs

Scalable

Scalable platform with built-in redundancy, failover, and 99.99% uptime

Simple

Open APIs and developer SDKs to create customized cards or payment products in a matter of days

Launch your next payment innovation?

Let’s talk about your use case and how we can help.

Contact us